maryland earned income tax credit 2019

Search for jobs related to Maryland earned income tax credit notice 2019 or hire on the worlds largest freelancing marketplace with 21m jobs. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to.

Reports And Pubs Cash Campaign Of Maryland

2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

. In May 2019 Governor Larry Hogan R signed legislation to significantly increase the size of the states Credit for Child and Dependent Care Expenses expand the. Earned Income Credit Maryland. Some part of his wages can be excluded by Foreign earned income.

The state EITC reduces the amount of Maryland tax you. I have a client whose domicile is state of MD but he has resided and worked in Foreign country from 2019. Alarmingly the percentage of people living in poverty in Maryland increased from 90 in 2019 to 103 in 2021.

Its free to sign up and bid on jobs. BALTIMORE MD The Maryland Department of Human Services is strongly encouraging eligible Marylanders to take advantage of the Earned Income Tax Credit Benefit. When both you and your spouse have taxable income you may.

Ad Guaranteed maximum refund. The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the. Read customer reviews best sellers.

2 A resident may claim a credit against the county income tax for a taxable year in the amount determined under subsection c of this section for earned income. The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. Maryland provides a deduction for two-income married couples who file a joint income tax return.

At the state level maintaining the expanded Earned Income. The state EITC reduces the amount of Maryland tax you. Ad Earned income credit maryland.

The state EITC reduces the amount of Maryland tax you. Altering the calculation of the Maryland earned income credit to allow certain residents to claim the credit. 27 earned income credit allowable for the taxable year under 32 of the Internal Revenue 28 Code that is attributable to Maryland determined by multiplying the federal earned 29 income.

2018 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. The maximum federal credit is 6728. 2018 Tax Returns Processed in 2019 by State with EITC Claims During 2019 25 million eligible workers and families nationwide received about 63 billion in EITC.

Register and Subscribe Now to work on your IRS Form 8867 more fillable forms. Its free to sign up and bid on jobs. Allowing certain taxpayers with federal adjusted gross income for.

Bill number does not exist. Browse discover thousands of unique brands. 2018 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

Your employees may be entitled to claim an EITC on their 2019 federal and Maryland resident income tax returns if both their federal adjusted gross income and their earned income is less. Eligibility and credit amount depends on your income. Browse Our Collection and Pick the Best Offers.

Check Out the Latest Info. E-File directly to the IRS. Search for jobs related to Maryland earned income tax credit notice 2019 or hire on the worlds largest freelancing marketplace with 20m jobs.

Enter a vaild keyword. B 1 Except as provided. Get your refund faster with free e-filing and direct deposit straight to your bank.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Maryland Refundwhere S My Refund Maryland H R Block

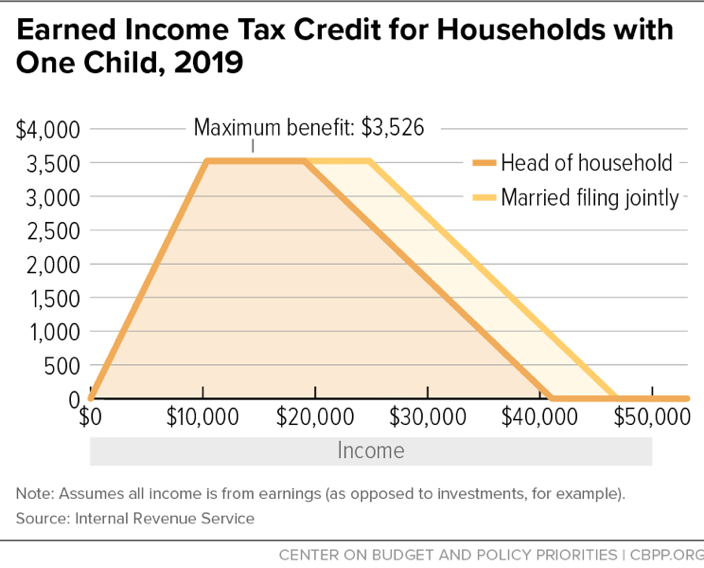

The Earned Income Tax Credit Hilary Hoynes 2019

State Individual Income Tax Rates And Brackets Tax Foundation

The Earned Income Tax Credit Hilary Hoynes 2019

Maryland Income Taxes Are Due This Friday Eye On Annapolis Eye On Annapolis

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

State Earned Income Tax Credits Urban Institute

Ready To File Your 2019 Federal State Income Tax Returns The Irs Will Start Accepting Your Tax Returns On January 27 2020 If You Are Claiming The By Martinez

Filing Maryland State Taxes Things To Know Credit Karma

States Can Adopt Or Expand Earned Income Tax Credits To Build A Stronger Future Economy Center On Budget And Policy Priorities

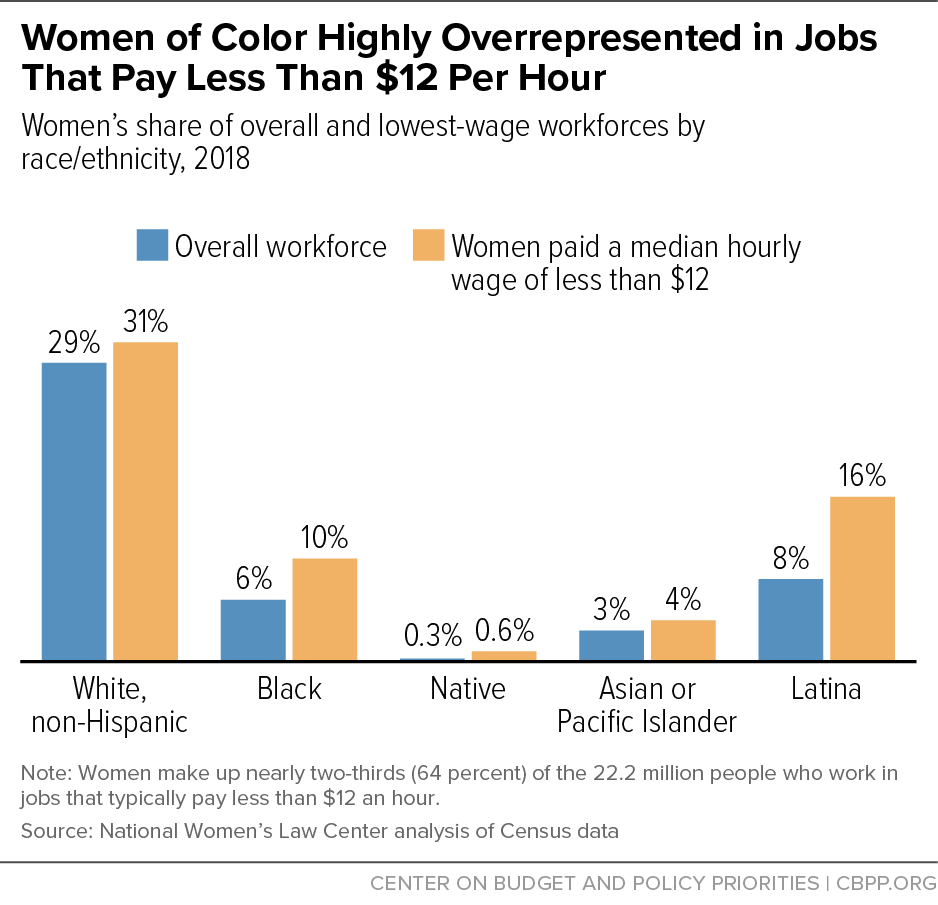

Expanding The Earned Income Tax Credit Will Benefit Maryland Workers And The Economy Maryland Center On Economic Policy

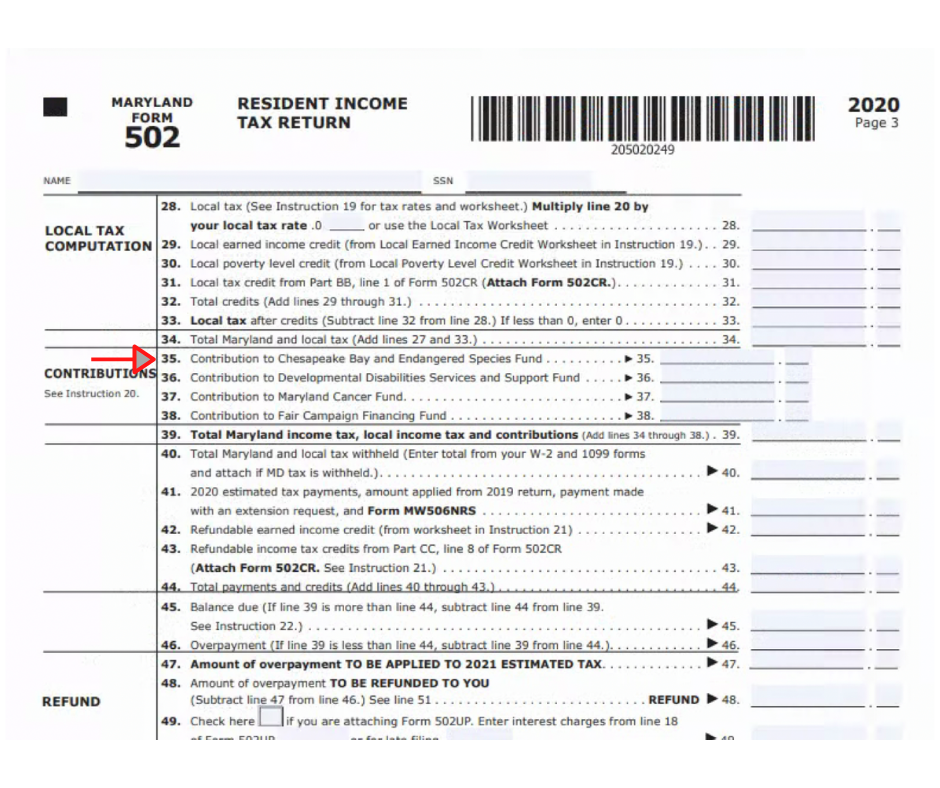

Tax Credits Deductions And Subtractions

Maryland Governor Larry Hogan Announces 1 86 Billion Tax Relief Program Hoffman Group

Taxhow Maryland Tax Forms 2019

Taxhow Maryland Tax Forms 2019

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep