high low method machine hours

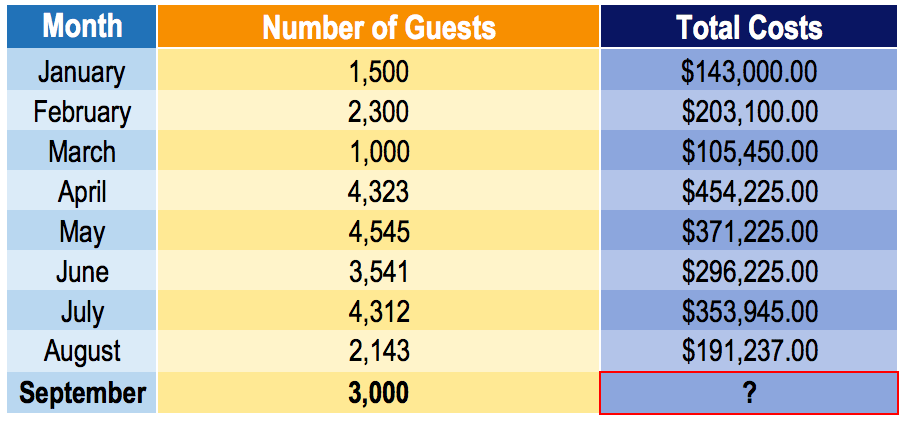

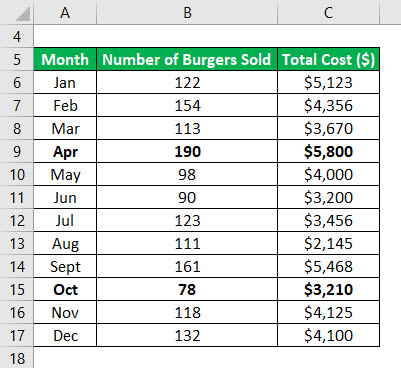

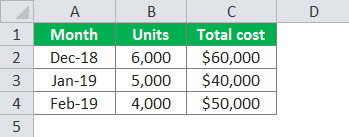

Recent data are shown below. It is a nominal difference and choosing either fixed cost for our cost model will suffice.

High Low Method Learn How To Create A High Low Cost Model

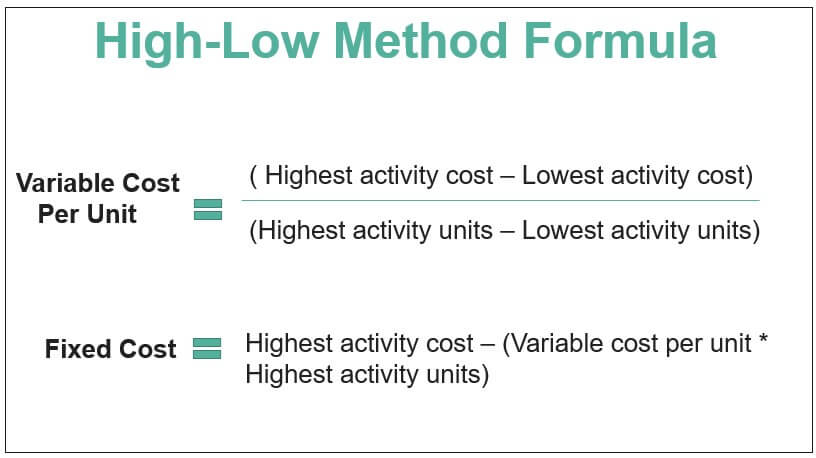

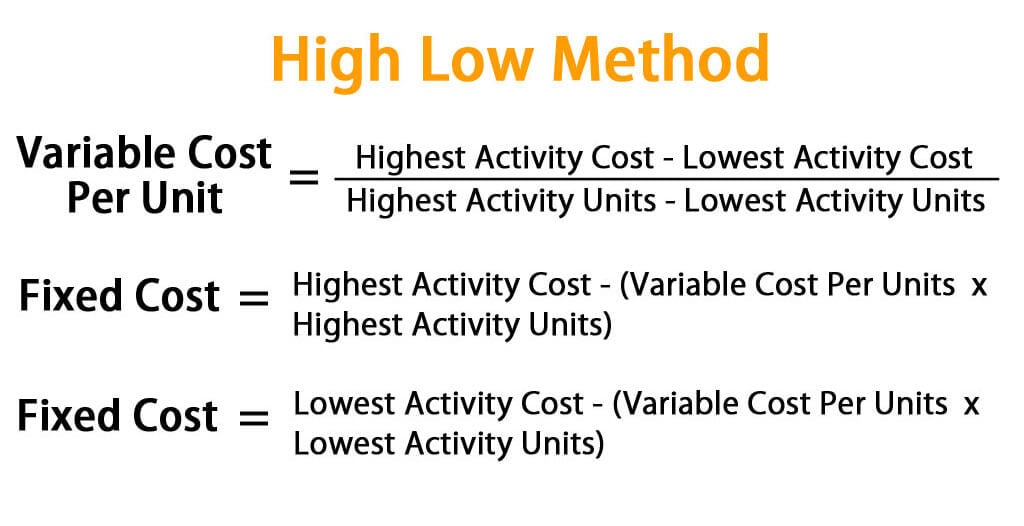

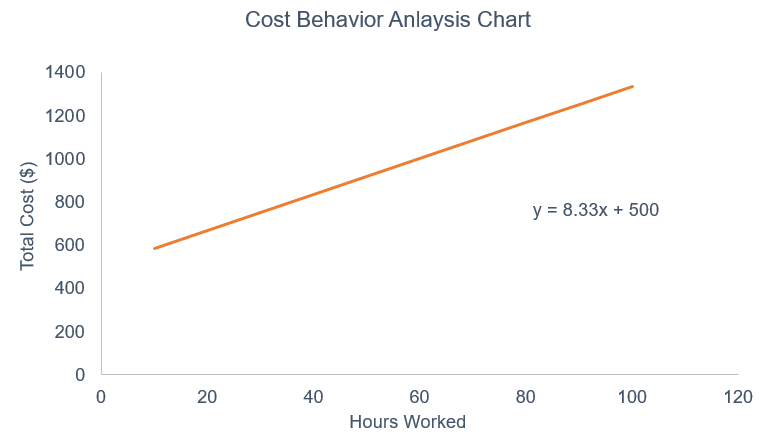

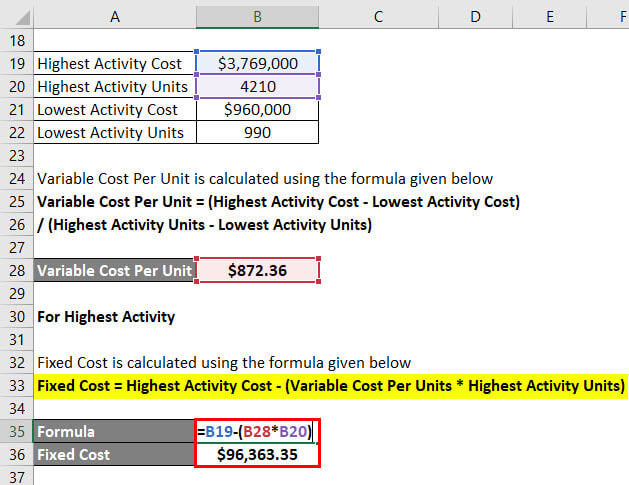

The high-low method is a simple technique for computing the variable cost rate and the total amount of fixed costs that are part of mixed costs.

/cost-accounting-b615845be6d5418e8b79152f473a902f.jpg)

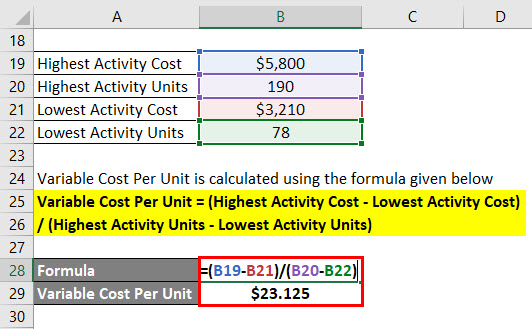

. Use High and low method to estimate Variable cost per unit 2. Machine Hours Electrical Cost January 4000 3120 February 6000 4460 March 4800 3500 April 5800 5040 May 3600 2900 June 4200 3200 Required. Lets begin by determining the formula that is used to calculate the variable cost slope.

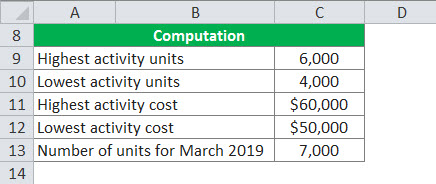

Change in cost Change in volume Variable cost slope 는 - X Data table Round the variable cost to the nearest cent Using the high-low method the variable utilities cost per machine hour is 160 Machine Hours 1050 Requirement 2. Barkoff Enterprises which uses the high-low method to analyze cost behavior has determined that machine hours best explain the companys utilities cost. Fixed cost 105450 7497 x 1000 30480.

Company recorded overhead costs of 18122 at an activity level of 5200 machine hours and. Barkoff Enterprises which uses the high-low method to analyze cost behavior has determined that machine hours best explain the companys utilities cost. Find the fixed cost 3.

Using the high-low method of analysis estimate the variable electrical cost per machine hour. High-Low method is one of the several mathematical techniques used in managerial accounting to split a mixed cost into its fixed and variable components. The companys relevant range of activity varies from a low of 600 machine hours to a high of 1200 machine hours with the following data being available for the first six months of the year.

Solve Y if x 13000 machine hours. The companys relevant range of activity varies from a low of 600 machine hours to a high of 1200 machine hours with the following data being available for the first six months of the year. State the cost function 4.

Units labor hours machine hours etc and the corresponding total cost figures high-low method only takes two extreme data pairs ie. Mixed costs are costs that are partially variable and partially fixed. High Low Method of Machine Hours 8000 10000 11000 9000 14000 12000 Total Maintenance Costs 600000 640000 800000 700000 900000 870000 Required.

The highest and the. We first find the cost function by taking the high and low costs. Note that our fixed cost differs by 635 depending on whether we use the high or low activity cost.

Was company which uses the high-low method to analyze cont behavior has determined that machine hours best predict the companys total utilities cost. The cost of electricity used in a factory is likely to be a mixed cost since some of the electricity will vary with the number of machine hours while some of the. Using either the high or low activity cost should yield approximately the same fixed cost value.

A manufacturing company estimates semi-variable costs by using the high-low method with machine hours as the cost driver. The companys cost and machine hour usage data for the first six months of the year follow Click the icon to view the data Read the requirements Requirement 1. Accounting questions and answers.

Period Semi-Variable Costs Machine Hours 1 100000 22000 2 120000 30000 3 96000 23600 If 29000 machine hours were budgeted for the next period estimated semi-variable costs would total A. Given a set of data pairs of activity levels ie. The high-low method of accounting is used to estimate the total costs per unit produced by a company.

High - 26020 hours 21000 Low - 22300 hours. Machine-Hours Maintenance Costs Highest observation of cost driver 140000 280000 Lowest observation of cost driver 95000 190000 Difference 45000 90000 Maintenance costs a b Machine-hours Slope coefficient b 90000 45000 2 per machine-hour Constant a 280000 280000 0 or Constant a 190000.

High Low Method In Accounting Definition Formula

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

High Low Method Accounting Meaning Formula Example And More In 2021 Accounting Accounting Principles Accounting Education

High Low Method In Accounting Definition Formula

Cost Behavior Analysis Analyzing Costs And Activities Example

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

High Low Method In Accounting Definition Formula

Calculation Of Overhead Absorption Rate Basic Concepts Of Financial Accounting For Cpa Exam

Toyota Production System Staff Motivation Leadership Skills Kaizen

Datadash Com Method To Create A Dataframe In Numpy And Pandas U Machine Learning Artificial Intelligence Data Science Machine Learning

High Low Method In Accounting Definition Formula

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

High Low Method In Accounting Definition Formula

/dotdash_Final_Using_Pivot_Points_for_Predictions_Feb_2020-01-b3d14a9e8e864875aa404a7664fbb23b.jpg)

Using Pivot Points For Predictions

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

High Low Method Learn How To Create A High Low Cost Model